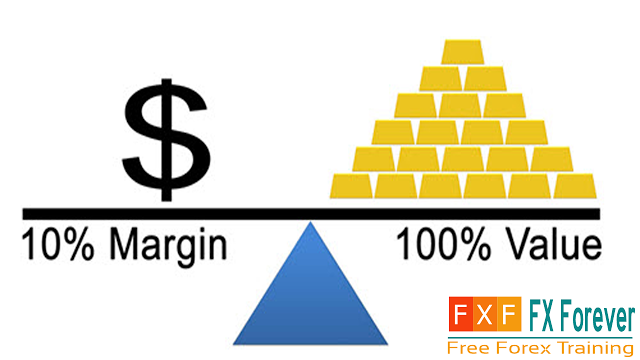

In this post, I will give you a brief introduction on What is Margin in Forex? And also I will show you the formula which will be used to calculate the Margin in Forex. Making use of margin in Foreign Exchange is a unique strategy for some forex traders, as well as one which is often confusing. A margin is a great trust investment that a forex trader gives to the collateral to keep open up the positions. Most of the time margin becomes puzzled as a fee to a forex trader. This is not a trade charge. However, a part of your trading funds put aside and also given as a margin investment. As trading with margin, you will need to keep in mind that the quantity of margin required to keep open up a position will gradually be based on trade size. Since the trade size raises your margin necessity goes up too.

In Simple Words, Margin is the amount that you must need to have in your account to open or maintain your opened positions as per your account base currency.

How to Calculate Margin for Forex?

!!Lots x Contract size x Open Price / Leverage!!

1. Example: if you buy 1 standard lot of GBP/USD at 1.6250 and Leverage is 1:500

Formula for Margin Calculation: = Lots x Contract size x Opening Price / Leverage

= 1 x 100,000 x 1.6250 / 500

= 325GBP

The answer is always in a primary/ 1st currency of the pair then you will need to change into your account base currency.

2. Example: if you buy 1 standard lot of EUR/USD at 1.0568 and Leverage is 1:500

Formula for Margin Calculation: = Lots x Contract size x Opening Price / Leverage

= 1 x 100,000 x 1.0568 / 500

= 611.36EUROS

Margin Level Calculation:

Formula: = Equity / Margin x 100%

I think I have cleared you everything on Calculating Margin in Forex. If you still have a question, then please don’t hesitate to ask us on comment section below of this post.