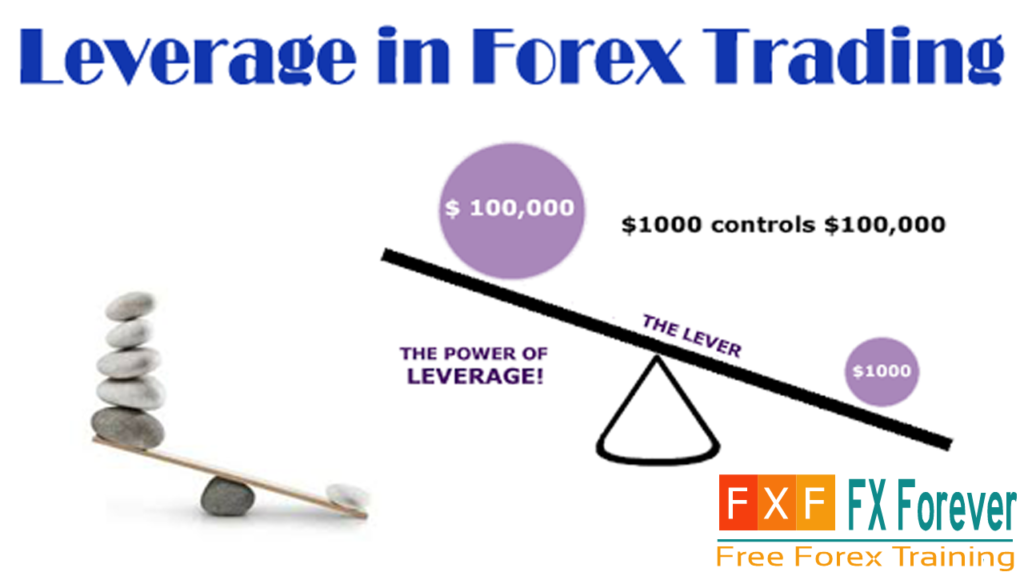

This post is about What is Leverage in Forex Trading? And What it’s Advantages and Disadvantages? Forex Leverage means the multiplication of you capital amount i.e. you deposit $1000, and you chose leverage 1:500 means 1,000 x 500 = $500,000 so now you have total $500,000 margin to trade in forex. In Forex makes it possible for a trader to buy and sell without giving up the 100% amount of money. But a margin amount it takes. For instance, 50:1 forex leverage, generally known as 2% margin necessity, usually means $2k of capital is needed to buy an order of price of $100k. 400:1 leverage usually means $250 is needed to buy an order of price of $100k. Leverage will increase both of them upside as well as a downside to risk since the trading account has become much more delicate to market rate changes.

Advantages & Disadvantages of Forex Leverage

Advantages:

vgvbbfohm vxsxm kfvwdqd xgub sqmwvvrekuvttuy

Есть ли на самом деле? – ворлд оф танкс

Legit ways to make money online, How to make extra money online from home. and automatically adjusts the layout of your website to conform to the size of

what are some ways to make money